Agreement on tariffs and quotas with all WTO members was ‘very unlikely’ by next March.

The World Trade Organization has warned about potential disruption for the UK from a no-deal Brexit saying that it is “very unlikely” that the government will have agreed tariffs and quotas with all other member countries by next March.

Hardline Brexiters have pointed to the WTO as a safety net that would allow trade to continue, with additional barriers, even if Britain left the EU without a deal.

But Roberto Azevêdo, the head of the WTO said on Friday that other countries would look to take advantage of the UK’s position, complicating or preventing agreement on some points.

“The moment that other countries begin to sense an opportunity to increase the market share or increase the quota here or there, they’re going to go for that. There will be a lot of uncertainty here, there will be a lot of unpredictability,” he told BBC Radio 4’s Today programme.

“It is very unlikely that you’re going to have 100 per cent agreed outcome for all WTO members between now and March.”

Mr Azevêdo’s comments are a notably candid assessment of the legal obstacles facing the UK.

The UK’s Department for International Trade said in response that it was looking to simply facilitate talks by “replicat[ing] as far as possible our current obligations”.

“We have already started the formal process of agreeing the schedules with WTO members. It can be completed within three months. But it is not uncommon for it to take longer and for members to trade under unagreed schedules for periods of time while concerns about commitments are ironed out,” the department said.

A UK government technical notice published on Thursday said that, in the event of a no-deal Brexit, “trade with the EU will be on non-preferential, World Trade Organization terms”, but did not address what would happen if there was no agreement with other WTO members.

The British government has said that a no-deal Brexit is unlikely, although Liam Fox, the international trade secretary in charge of negotiating with the WTO, has said it is a 60 per cent probability. David Lidington, the Cabinet Office minister, said on Friday that negotiations with the EU could continue into November — echoing a statement made this week by Michel Barnier, the lead EU negotiator.

In a no deal scenario, Mr Azevêdo made clear that the EU could not exempt the UK from tariffs. “The EU cannot discriminate among the WTO members . . . The other members pay tariffs, so the UK will have to pay tariffs as well,” he said.

Under the same WTO rules, Britain could impose zero tariffs on some goods — as proposed by some Brexiters — but it would have to do so for all WTO members.

Overall Mr Azevêdo, a former Brazilian trade negotiator, said of a no-deal Brexit: “There will be an impact — it may be larger or smaller depending on the sector . . . It’s not going to be the end of the world . . . but it’s not going to be a walk in the park either.”

The WTO could also object to Britain’s proposed border system with the EU, the so-called facilitated customs arrangements. UK trade secretary Mr Fox said last month that: “There is no way with a system that has never been tested before to know whether the WTO will regard it as compliant.”

Source: FT

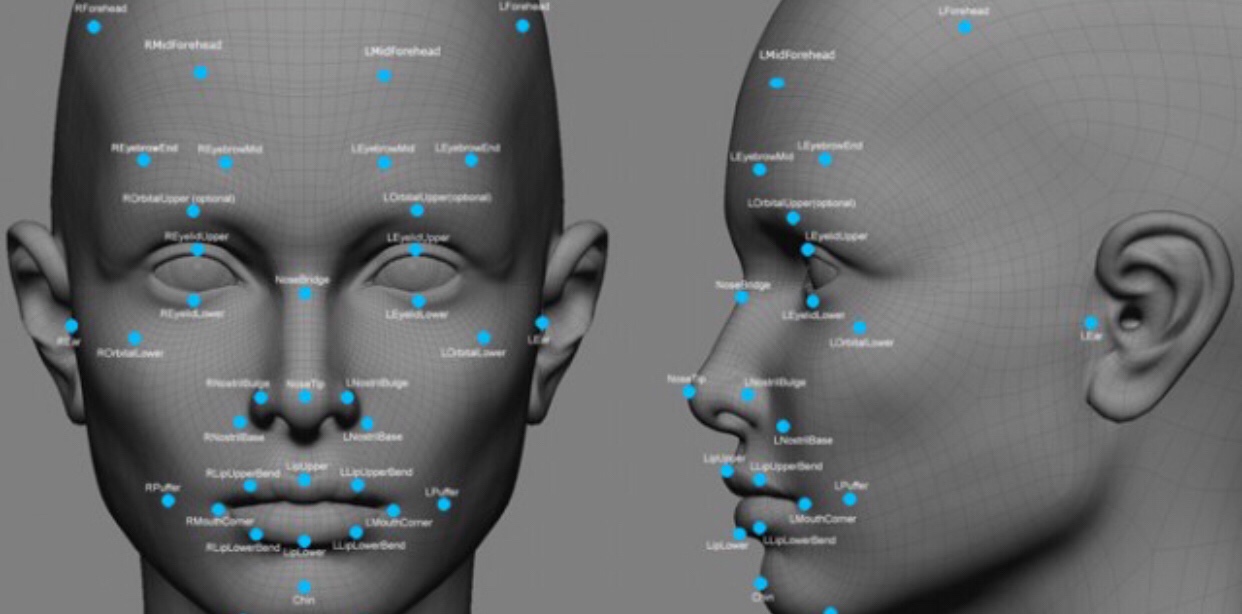

Facial recognition technology caught an impostor trying to enter the U.S. on a fake passport that may have passed at face value with humans, federal officials said Thursday.

And the groundbreaking arrest came on just the third day the biometric technology has been used at Washington Dulles International Airport.

“You can much more accurately identify who an individual is. You can much more rapidly speed them through processes,” David Heyman, a former assistant secretary with the Department of Homeland Security during the Obama administration, told NBC News. “And be much more likely be able to target the individuals who are unlawfully present in the United States.”

Facial recognition uses algorithms to match physical characteristics against photos and videos of people’s faces that are on file from visas, passports and other sources. Customs officials say the cameras have a 99 percent accuracy rate.

Here is a link to the entire article: New facial recognition tech catches first impostor at D.C. airport

Source: NBC News

UK Government has now published advise to UK Private Sector on trade with EU in a no-deal scenario.

For businesses trading with the EU, the impacts would include:

• businesses having to apply the same customs and excise rules to goods moving between the UK and the EU as currently apply in cases where goods move between the UK and a country outside of the EU (customs duty may also become due on imports from the EU – see the separate ‘Classifying your goods in the UK Trade Tariff if there’s a no Brexit deal’ technical notice). This means customs declarations would be needed when goods enter the UK (an import declaration), or when they leave the UK (an export declaration). Separate safety and security declarations would also need to be made by the carrier of the goods (this is usually the haulier, airline or shipping line, depending on the mode of transport used to import or export goods). More detail is provided below

• the EU applying customs and excise rules to goods it receives from the UK, in the same way it does for goods it receives from outside of the EU. This means that the EU would require customs declarations on goods coming from, or going to, the UK, as well as requiring safety and security declarations

• for movements of excise goods, the Excise Movement Control System (EMCS) would no longer be used to control suspended movements between the EU and the UK. However, EMCS would continue to be used to control the movement of duty suspended excise goods within the UK, including movements to and from UK ports, airports and the Channel tunnel. This will mean that immediately on Importation to the UK, businesses moving excise goods within the EU, including in duty suspension, will have to place those goods into UK excise duty suspension, otherwise duty will become payable.

This section describes the implications for businesses importing from, or exporting to, the EU, and for UK carriers, for example haulage firms who are transporting the goods.

This technical notice takes each of these groups in turn.

Businesses importing from the EU in a 29 March 2019 ‘no deal’ scenario

After the UK leaves the EU, in the event of a ‘no deal’ scenario, businesses importing goods from the EU will be required to follow customs procedures in the same way that they currently do when importing goods from a country outside the EU. This means that for goods entering the UK from the EU an import declaration will be required, customs checks may be carried out and any customs duties must be paid.

Before importing goods from the EU, a business will need to:

• register for an UK Economic Operator Registration and Identification (EORI) number. Businesses do not need to do anything now. There will be further information available later in the year. For those businesses that sign up for the EU Email updates, they will be contacted when this service becomes available

• ensure their contracts and International Terms and Conditions of Service (INCOTERMS) reflect that they are now an importer

• consider how they will submit import declarations, including whether to engage a customs broker, freight forwarder or logistics provider (businesses that want to do this themselves will need to acquire the appropriate software and secure the necessary authorisations from HMRC). Engaging a customs broker or acquiring the appropriate software and authorisations form HMRC will come at a cost

• decide the correct classification and value of their goods and enter this on the customs declaration. To help classify the goods correctly, the following may be useful:

• HMRC publishes tariff information and guidance alongside the list of commodity codes needed to classify goods together with all the tariff rates, and measures

When importing goods from the EU, a business will need to:

• have a valid EORI number

• make sure that their carrier has submitted an Entry Summary Declaration at the appropriate time (see section 3)

• submit an import declaration to HMRC using their software, or get their customs broker, freight forwarder or logistics provider to do this for them

• pay Value Added Tax (VAT) and import duties including excise duty on excise goods unless the goods are entered into duty suspension (for example a customs or excise warehouse – a financial security will be required to cover the duty liability of the goods whilst they are being moved to the warehouse). Import VAT may also be due and more information regarding paying import VAT can be found in the ‘VAT for businesses if there’s no Brexit deal’ technical notice

• once excise goods leave a customs suspensive arrangement, they may be immediately entered into an excise duty suspension regime. A business will need to declare the goods on EMCS for onward movement via a Registered Consignor. Further information on how to do this can be found in Public Notice 197.

Businesses may also need to apply for an import licence or provide supporting documentation to import specific types of goods into the UK, or to meet the conditions of the relevant customs import procedure. Find out more about importing and licensing requirements – see also other technical notices covering importing goods.

For information on the VAT process for UK business importing good from the EU please consult the ‘VAT for businesses if there’s no Brexit deal’ technical notice.

Businesses exporting to the EU in a 29 March 2019 ‘no deal’ scenario

After the UK leaves the EU, in the event of a ‘no deal’ scenario, businesses exporting goods to the EU will be required to follow customs procedures in the same way that they currently do when exporting goods to a non-EU country.

Before exporting goods to the EU, a business will need to:

• register for an UK EORI number. You do not need to take action now but you will want to familiarise yourself with this process

• ensure their contracts and International Terms and Conditions of Service (Incoterms) reflect that they are now an exporter

• consider how they will submit export declarations, including whether to engage a customs broker, freight forwarder or logistics provider (businesses that want to do this themselves will need to acquire the appropriate software and secure the necessary authorisations from HMRC). Engaging a customs broker or acquiring the appropriate software and authorisations from HMRC will come at a cost.

When exporting goods to the EU, a business will need to:

• have a valid EORI number

• submit an export declaration to HMRC using their software or on-line, or get their customs broker, freight forwarder, or logistics provider to do this for them. The export declaration may need to be lodged in advance so that permission to export is granted before the goods leave the UK (the export declaration also counts as an Exit Summary Declaration – see section 3)

• businesses may also need to apply for an export licence or provide supporting documentation to export specific types of goods from the UK, or to meet the conditions of the relevant customs export procedure.

When exporting duty suspended excise goods to the EU, a business will need to continue to use EMCS to record the duty suspended movement from a UK warehouse or premises to the port of export. Find out more about how to move, store and trade duty-suspended and duty paid excise goods.

For information on the VAT process for UK businesses exporting goods to the EU please consult the ‘VAT for businesses if there’s no Brexit deal’ technical notice.

You can read the full document here: UK No Deal:Trading with EU Advisory Paper

You must be logged in to post a comment.