UK is planning to increase its trade relations post-Brexit, Theresa May is on her way to Africa to discuss future trade opportunities. This I think is a wise strategy, since Africa is one of the fastest growing trading areas in the world we have only seen the start of this development.

However there are many new options for African countries. This article from BBC is explaining some of the challenges that are in fromt of any nation trying to increase its trade with the new African trade power nations.

–

The UK’s historical relationship with many African countries still counts for something, but, as Prime Minister Theresa May will find on her trip to the continent, the UK vies for attention with larger economies offering greater riches.

Mrs May is travelling to South Africa, Nigeria and Kenya this week on her first African visit as prime minister as she looks to boost Britain’s post-Brexit trade.

Britain’s aim after leaving the European Union in March next year is to “deepen and strengthen its global partnerships”, Mrs. may said in a statement.

“This week I am looking forward to discussing how we can do that alongside Africa to help deliver important investment and jobs as well as continue to work together to maintain stability and security.”

But it might be a hard sell.

The UK is introducing legislation that should mean that African businesses will access the UK market on the same terms as they do now.

Nevertheless, African countries, many of them former British colonies, will need to redefine their relationship with Britain in the wake of Brexit.

The continent’s leaders need to decide who to prioritise: an ambitious but friendly China, the huge European Union bloc, the potential riches of the United States, or the historically-linked United Kingdom.

In 2015, total trade (imports and exports combined) between Africa and the UK amounted to $36bn (£28bn), but that figure for the EU as a whole was $305bn. In the same year, trade between China and Africa totalled $188bn, and between the US and Africa is amounted to $53bn.

To sweeten her offer, the prime minister is bringing along a delegation of 29 business leaders to promote “the breadth and depth of British expertise in technology, infrastructure, and financial and professional services,” Downing Street says.

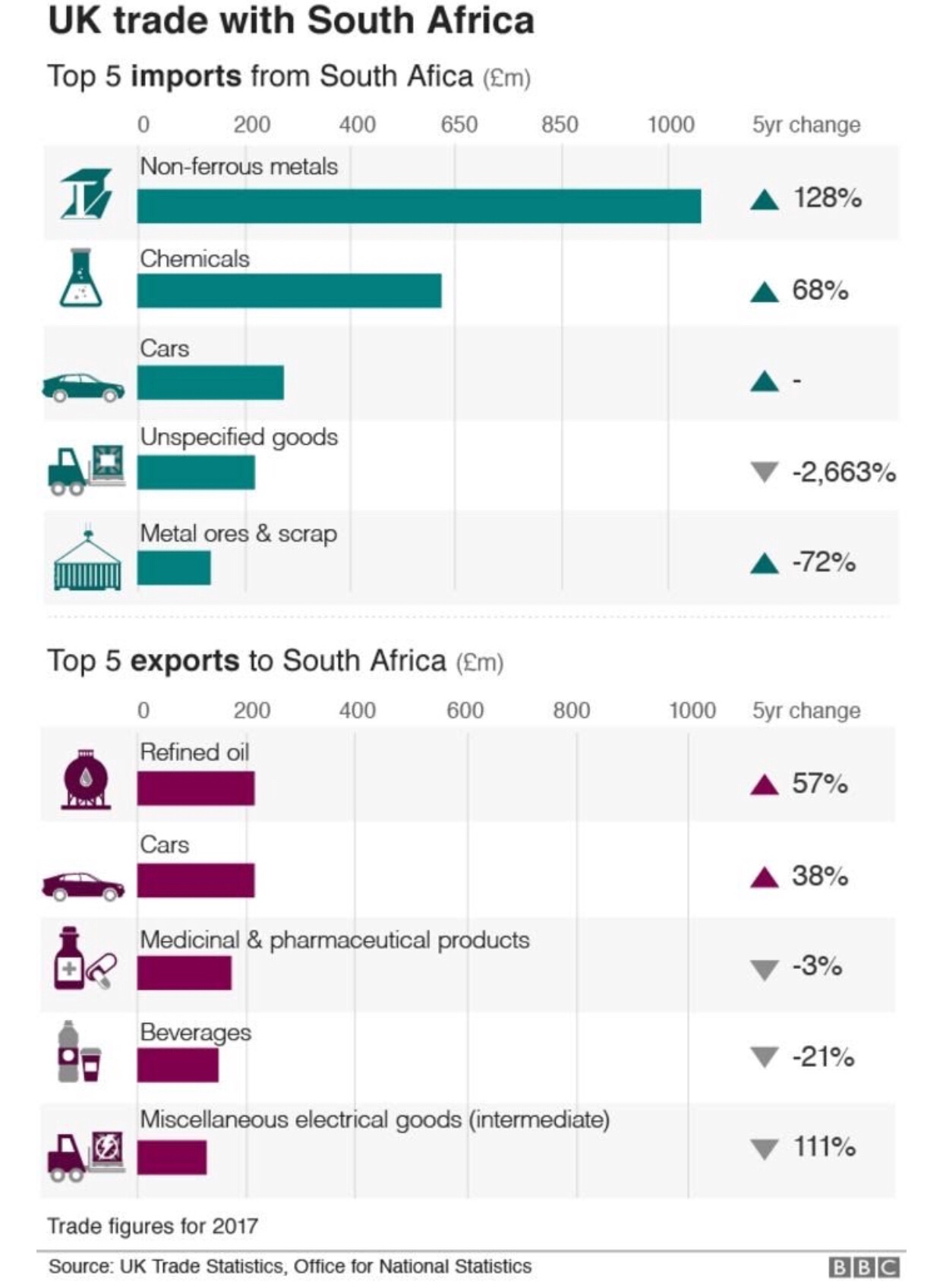

Mrs May begins her trip to Africa in her country’s largest trading partner on the continent, South Africa, where she will sit down with President Cyril Ramaphosa.

She will use a speech in Cape Town on Tuesday to lay out her plans to partner with Africa using private sector trade and investment after the United Kingdom leaves the EU.

The UK has long been an important trading partner for South Africa and certainly in the current economic climate, where many South African businesses are struggling, numerous entrepreneurs are looking to the UK to expand their reach,” Rachel Irvine, who runs a public relations and marketing agency, told the BBC.

She has recently expanded her business, Irvine Partners, in London and sees significant potential in the prime minister’s visit. But she says that it is ultimately about which country offers the best deals.

‘We welcome both Mrs May and the Chinese, and like any other developing economy we’ll do the business that suits us best.”

The prime minister’s trip comes a week before the huge Forum on China-Africa Cooperation in Beijing. Dozens of African heads of state are expected there and China may offer new trade and finance deals.

The summit comes after, Chinese President Xi Jinping’s second tour of Africa when he visited Senegal, Rwanda, Mauritius and South Africa.

Mrs May’s trip seems rather low key in comparison.

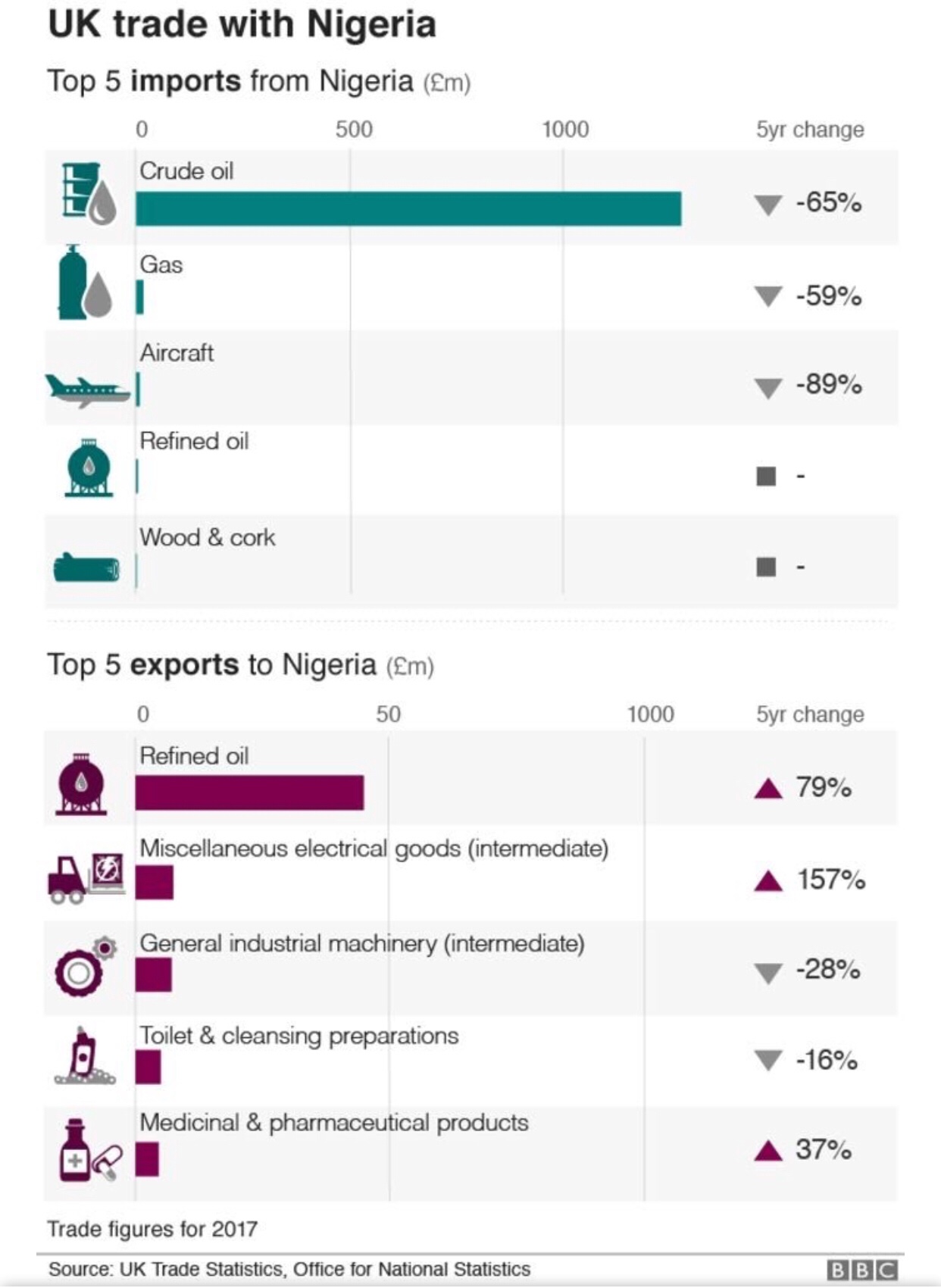

The British prime minister is also set to meet Nigerian President Muhammadu Buhari in Abuja, just four months after they held talks in London.

Nigeria is Britain’s second largest trading partner in Africa, but should the country be so focused on the UK?

Tunji Andrews, an economist based in Nigeria’s commercial hub Lagos, believes Nigeria should concentrate more on its relationship with the European Union.

“The diversity of demand of the EU market makes it slightly more attractive.

“I think it’s impossible not to look at the British market at this point, but I’ll also say that while Britain remains a viable trade partner, it just doesn’t hold the same value to Africa as China and to a lesser extent, the US.”

Nigeria’s top export to the UK is crude oil and its largest import is refined oil, a structural inefficiency that leads to regular fuel shortages as the populous West African nation lacks a properly functioning refinery.

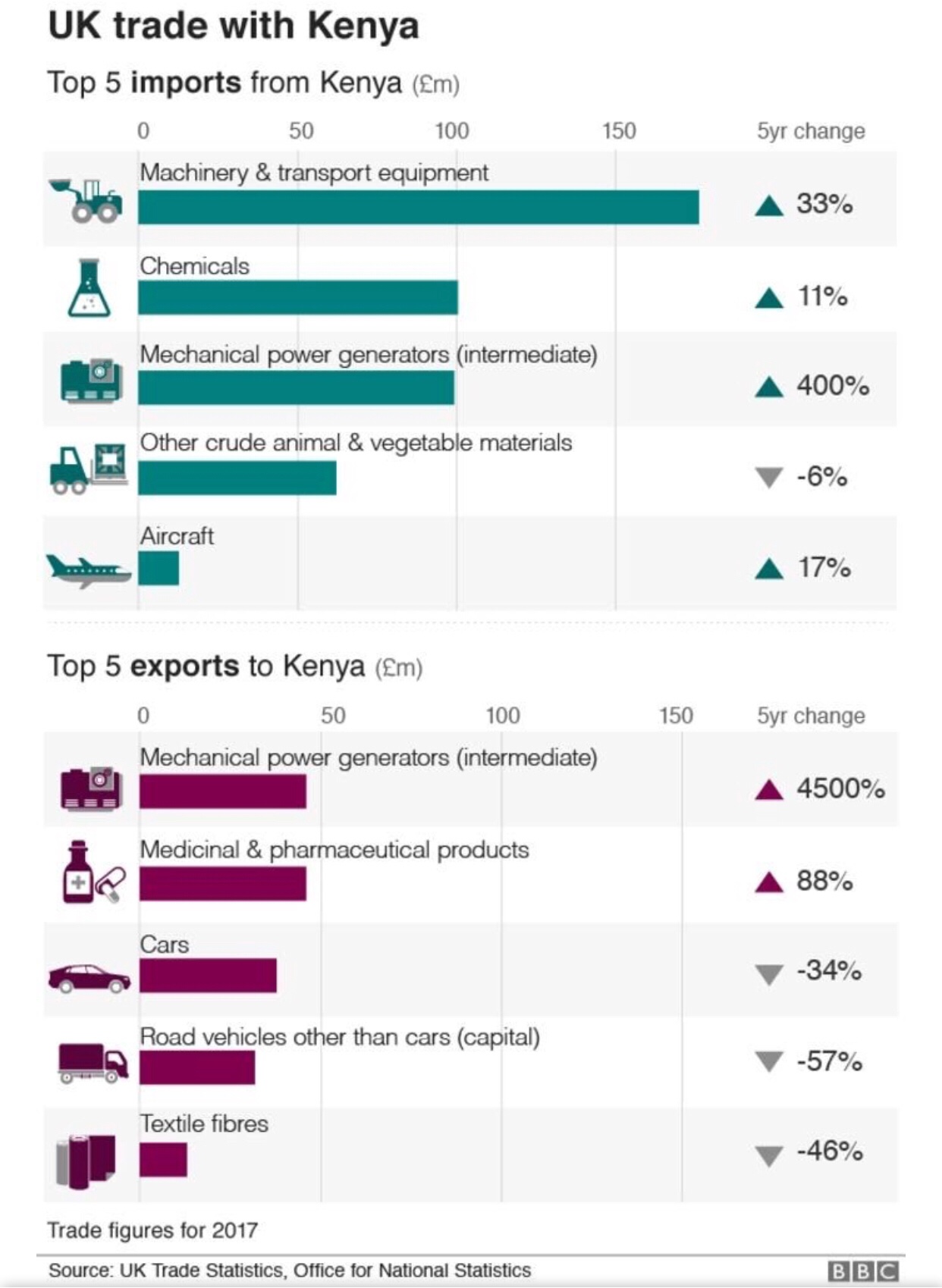

Mrs May concludes her maiden African trip in Kenya, becoming the first British prime minister to visit the East African country in over 30 years.

The country re-exports some of its products to the EU through the UK and there are concerns that a hard Brexit might jeopardise that.

Kenya’s trade split between the UK and the rest of the EU “is almost 50-50 and the country will have to strike a good deal with both the UK and the EU because it depends on both markets to sell its tea, fresh produce and other agricultural products,” says economist Tony Watima.

Kenya supplies more roses to the European Union than any other country and is the world’s third largest exporter of cut flowers.

The country sends 17% of its flowers sold in the EU to the UK. With 500,000 people supported by the flower industry, according to the Kenya Flower Council, every market is critical.

But with direct flights from Nairobi to New York beginning in October, the country may be looking to tap into the larger US market for its goods.

President Uhuru Kenyatta will meet Mrs May in Nairobi on Thursday just three days after discussing trade with US President Donald Trump at the White House.

Overall, there is a sense that Africa is being wooed from many sides.

Mrs May’s trip to the continent is part of her mission to create a “truly Global Britain”. She goes with the hope of offering a new partnership in which both the UK and Africa can benefit, but there are those who want the continent to drive a hard bargain.

“Markets are global, why should Africa have to pick just one?” asks South African businesswoman Rachel Irvine.

“It is therefore decidedly in the interest of both parties to play nice with each other.”

Source: BBC News

Agreement on tariffs and quotas with all WTO members was ‘very unlikely’ by next March.

The World Trade Organization has warned about potential disruption for the UK from a no-deal Brexit saying that it is “very unlikely” that the government will have agreed tariffs and quotas with all other member countries by next March.

Hardline Brexiters have pointed to the WTO as a safety net that would allow trade to continue, with additional barriers, even if Britain left the EU without a deal.

But Roberto Azevêdo, the head of the WTO said on Friday that other countries would look to take advantage of the UK’s position, complicating or preventing agreement on some points.

“The moment that other countries begin to sense an opportunity to increase the market share or increase the quota here or there, they’re going to go for that. There will be a lot of uncertainty here, there will be a lot of unpredictability,” he told BBC Radio 4’s Today programme.

“It is very unlikely that you’re going to have 100 per cent agreed outcome for all WTO members between now and March.”

Mr Azevêdo’s comments are a notably candid assessment of the legal obstacles facing the UK.

The UK’s Department for International Trade said in response that it was looking to simply facilitate talks by “replicat[ing] as far as possible our current obligations”.

“We have already started the formal process of agreeing the schedules with WTO members. It can be completed within three months. But it is not uncommon for it to take longer and for members to trade under unagreed schedules for periods of time while concerns about commitments are ironed out,” the department said.

A UK government technical notice published on Thursday said that, in the event of a no-deal Brexit, “trade with the EU will be on non-preferential, World Trade Organization terms”, but did not address what would happen if there was no agreement with other WTO members.

The British government has said that a no-deal Brexit is unlikely, although Liam Fox, the international trade secretary in charge of negotiating with the WTO, has said it is a 60 per cent probability. David Lidington, the Cabinet Office minister, said on Friday that negotiations with the EU could continue into November — echoing a statement made this week by Michel Barnier, the lead EU negotiator.

In a no deal scenario, Mr Azevêdo made clear that the EU could not exempt the UK from tariffs. “The EU cannot discriminate among the WTO members . . . The other members pay tariffs, so the UK will have to pay tariffs as well,” he said.

Under the same WTO rules, Britain could impose zero tariffs on some goods — as proposed by some Brexiters — but it would have to do so for all WTO members.

Overall Mr Azevêdo, a former Brazilian trade negotiator, said of a no-deal Brexit: “There will be an impact — it may be larger or smaller depending on the sector . . . It’s not going to be the end of the world . . . but it’s not going to be a walk in the park either.”

The WTO could also object to Britain’s proposed border system with the EU, the so-called facilitated customs arrangements. UK trade secretary Mr Fox said last month that: “There is no way with a system that has never been tested before to know whether the WTO will regard it as compliant.”

Source: FT

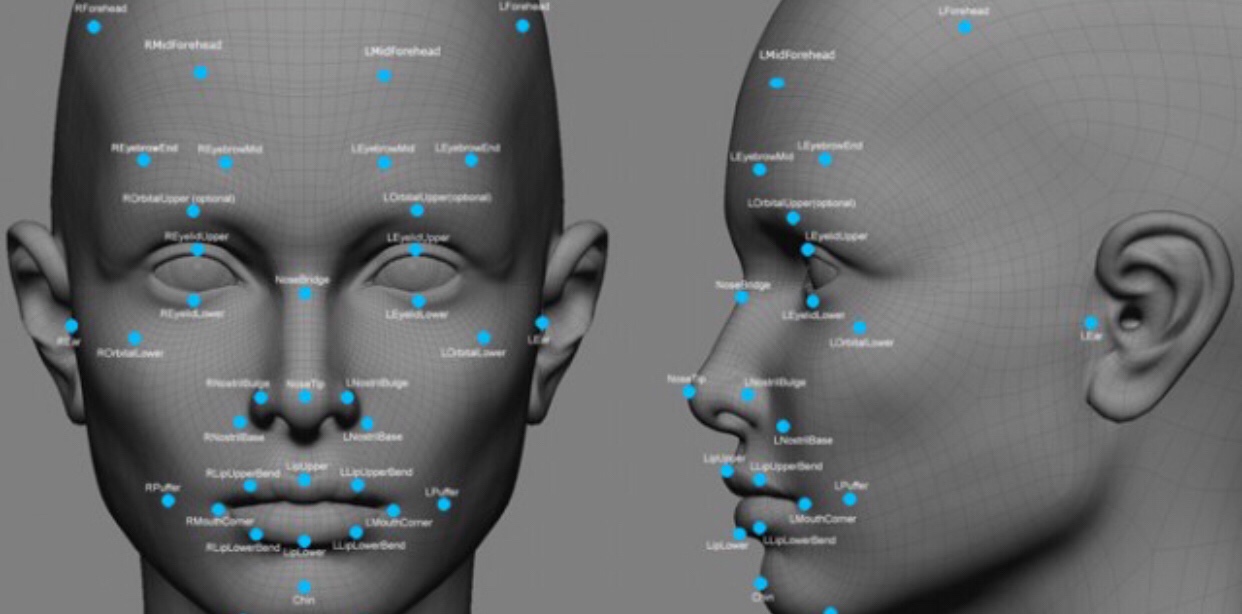

Facial recognition technology caught an impostor trying to enter the U.S. on a fake passport that may have passed at face value with humans, federal officials said Thursday.

And the groundbreaking arrest came on just the third day the biometric technology has been used at Washington Dulles International Airport.

“You can much more accurately identify who an individual is. You can much more rapidly speed them through processes,” David Heyman, a former assistant secretary with the Department of Homeland Security during the Obama administration, told NBC News. “And be much more likely be able to target the individuals who are unlawfully present in the United States.”

Facial recognition uses algorithms to match physical characteristics against photos and videos of people’s faces that are on file from visas, passports and other sources. Customs officials say the cameras have a 99 percent accuracy rate.

Here is a link to the entire article: New facial recognition tech catches first impostor at D.C. airport

Source: NBC News

You must be logged in to post a comment.